Creating a company in a foreign state can be a frightening activity. From navigating regional regulations and restrictions to knowing tax codes, there are various challenges that business owners experience when setting up a business abroad. Even so, with the appropriate guidance and assistance, developing a business in the international nation can be a rewarding undertaking. In the following paragraphs, We'll discover the varied possibilities accessible to entrepreneurs wanting to ascertain a company within the United Arab Emirates (UAE), which includes offshore firm development, company restructuring, and small business setup in Dubai.

Offshore Organization Formation: What You have to know

Offshore enterprise development is a popular choice for entrepreneurs looking to extend their corporations globally. An offshore firm is really a lawful entity that is definitely registered in the foreign jurisdiction, individual from your operator's place of residence. There are plenty of Added benefits to creating an offshore company, which include tax positive aspects, privateness, and asset safety.

Deciding on the Proper Jurisdiction

Deciding on the proper jurisdiction is significant when organising an offshore company. Various jurisdictions present different Positive aspects and disadvantages, so it is important to exploration your options and choose the one which most closely fits your needs. Some common offshore jurisdictions involve the British Virgin Islands, the Cayman Islands, as well as the Seychelles.

When picking out a jurisdiction, think about components such as tax charges, privacy legislation, and political steadiness. It's also crucial making sure that the jurisdiction you choose has potent legal protections in place for organizations.

Registering Your organization

To sign-up your offshore enterprise, You will need to work by using a registered agent during the chosen jurisdiction. The agent can help you prepare the necessary documents and file them With all the appropriate authorities. The moment your business is registered, you can expect to get a certification of incorporation and have the capacity to perform small business during the picked out jurisdiction.

When deciding upon a registered agent, it is vital to settle on a dependable company with practical experience Performing while in the decided on jurisdiction. The agent need to be capable of supply advice and assistance throughout the registration system.

Banking and Tax Things to consider

Offshore firms can give major tax positive aspects, but it's important to operate with a professional tax Expert to ensure compliance with community rules and regulations. You can expect to also ought to open a checking account within the picked out jurisdiction, which may be an advanced approach. Working with a dependable economic establishment might help streamline this method and make sure compliance with area banking legal guidelines.

When selecting a financial institution, consider variables such as costs, desire prices, and name. It's also crucial in order that the bank you choose has working experience dealing with offshore companies.

Corporate Restructuring: What It can be and Why It Issues

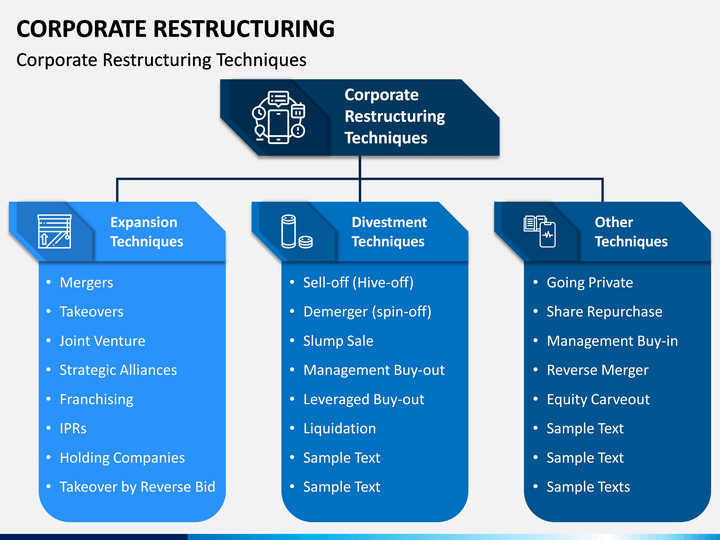

Corporate restructuring refers to the entire process of reorganizing a firm's composition, operations, or ownership. There Corporate restructuring are various main reasons why a company may have to restructure, which include mergers and acquisitions, financial distress, or even a transform in business method.

Forms of Company Restructuring

There are plenty of kinds of corporate restructuring, like mergers and acquisitions, divestitures, spin-offs, and joint ventures. Just about every type of restructuring has its personal Rewards and downsides, with regards to the distinct situation of the corporate.

Mergers and acquisitions require The mixture of two or even more firms into an individual entity. This can be a advantageous way for businesses to gain access to new marketplaces or develop their operations.

Divestitures include the sale of an organization's assets or business enterprise models. This can be a method for corporations to scale back financial debt or refocus their company strategy.

Spin-offs contain the development of a whole new, independent enterprise from the division or subsidiary of an present organization. This can be a method for organizations to unlock value and make improvements to their Over-all functionality.

Joint ventures include the generation of a whole new business with A further small business or companies. This may be a way for providers to share